Employer Connect Videos

Paying Fees From Plan Assets

COVID-19 is obviously causing financial stress and, when it comes to your qualified retirement plan, you may be looking for ways to reduce expenses. You have the option to use plan assets to pay some plan expenses, as long as you follow Department of Labor and IRS...

How the CARES Act Applies to Your Retirement Plan

The Coronavirus Aid, Relief and Economic Security (CARES) Act includes provisions that may apply to your retirement plan. Here are some important highlights to know first.

SECURE Act

The goal of our nation’s retirement system is to create more opportunities for American workers to save and to make it easier for employers like you to start and maintain benefit plans. With this in mind, Congress just passed, and the President signed the SECURE Act.

Your World Evolves and Your Retirement Plan Should, Too

The written version of your retirement plan, your plan document, defines how the plan operates. Naturally, when you started your plan, it reflected what we knew about you and your company at that moment in time.

Four Things to Know About ERISA Fidelity Bonds and Fiduciary Liability Insurance

The Employee Retirement Income Security Act known as “ERISA” regulates 401(k) and most other types of employee benefit plans. Under ERISA, anyone who handles retirement plan funds must be covered by a fidelity bond.

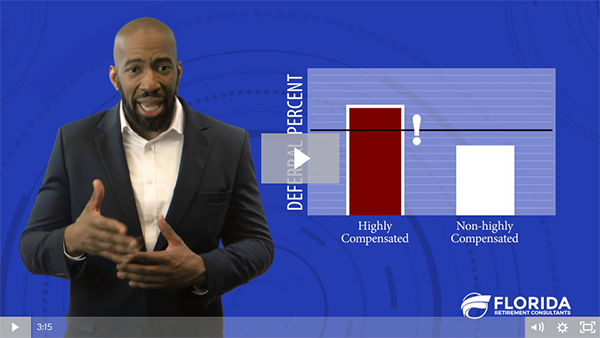

Encourage Greater Participation with a QACA Safe Harbor

401(k) is a very popular retirement plan and, like other plan designs, it allows your employees to take advantage of tax deferrals on contributions and earnings while their money accumulates for retirement. To enjoy this special status, the IRS put in place rules to assure your plan benefits rank and file employees and not just company owners and highly compensated employees.

It’s Time to Restate Your Defined Benefit Plan Document

Every retirement plan is required to have a formal written document that spells out how it operates. When Congress passes new laws that impact how retirement plans work, the IRS and other agencies create new regulations to reflect these changes and, as you might...

Cash Balance Plans Allow Six Figure Annual Contributions

Most people can contribute to their 401(k) without worrying about exceeding the annual contribution limit. If you're under 50 years old, that's $19,500 a year. If you're 50 or older, it's $26,000. A small, but important segment of the population, though, has the...

Understanding Why a QDIA Matters

Auto-enrollment has been proven to be effective in raising participation rates in 401(k) plans. As a result, it's been pretty widely adopted across the country, especially in mid- to larger plans. Automatic enrollment creates a situation where many employees fail to...

To Roth or Not to Roth

A compelling feature of a 401(k) plan has always been the opportunity to contribute money from your current income on a pre-tax basis today - let it work for you over the years - and then pay taxes on the accumulated balance as you withdraw it in future. That's a real...

Financial Wellness Is Essential to Saving for Retirement

Introducing a workplace retirement plan can be a compelling way for emplyees to take control of their retirement savings, but for so many people that don't have control of their personal financial situation, the retirement plan at work doesn't have a chance to be...

Defined Benefit Plans are Alive and Well

For the most part, the news about Defined Benefit plans lately has not been particularly good. Whether a big company could no longer fund its plan or how it was bankrupting their business, headlines have discouraged many businesses from seriously considering a DB...

Aligning Plan Design with Your Goals

Most of us live in homes that were not custom-designed for us. We adapt to them rather than expect them to be optimized to how we like to live. Most retirement plans are sold the same way.

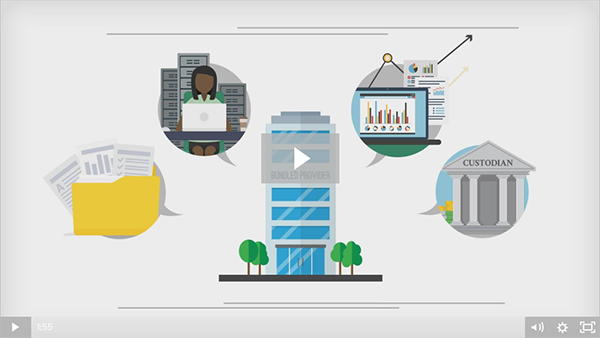

Advantages of an Unbundled Retirement Plan Solution

There are some things we're happy to buy right off the rack. After all, mass production usually means consistency and cost-savings. On the other hand, when we do buy off the shelf, we compromise on individual choice and sometimes flexibility in getting the exact...

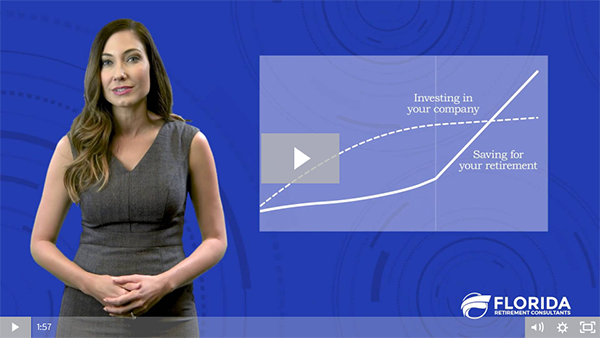

Maximizing a Business Owner’s Retirement Benefit

It's a common story - business owners put everything into their businesses for years before being in a financial position to put real money away for retirement. Once you're ready to really get going, we can suggest a number of retirement plan designs and individual...

Understanding How Forfeitures Work in Your Retirement Plan

When we talk about 401(k) retirement plans, we sometimes focus on the contributions made by employees that are always immediately vested. In other words, it's their money and they can always withdraw it without forfeiting any - subject to certain IRS rules about early...

The Loan They Never Take May Make All the Difference

IRS rules provide for participant loans and hardship withdrawals from 401(k) and other plans. They're not required, but rather left to the discretion of you, the plan sponsor. Today, there's a good bit of debate about how participant loans affect long-term retirement...

Plan Fiduciary Services and Why They Matter

People who exercise control and authority over the management of a retirement plan's assets are fiduciaries. So are professionals who provide investment advice with respect to those assets. As a company owner or executive, in most cases you also play an investment...

Did You Know You Are a Fiduciary?

When it comes to the topic of fiduciary responsibilities for qualified retirement plans, there are three things we know really well: Plan sponsors like you are, by definition, a fiduciary of your plan because you exercise control over, and act on behalf of, your plan....

When to Set Sail with Safe Harbor

You already know that a 401(k) is a very popular retirement plan and, like other plan designs, it allows your employees to take advantage of tax deferrals on contributions and earnings while their money accumulates for retirement. To enjoy this special status, the IRS...

Auto Enrollment and Auto-Escalation

When we think about the important goals we've reached in our lives, like graduating from college or achieving a career milestone, the journey likely took time, perseverance, and a whole lot of hard work. But the payoffs in the end are the rewards we've earned and the...